Planning Process

|

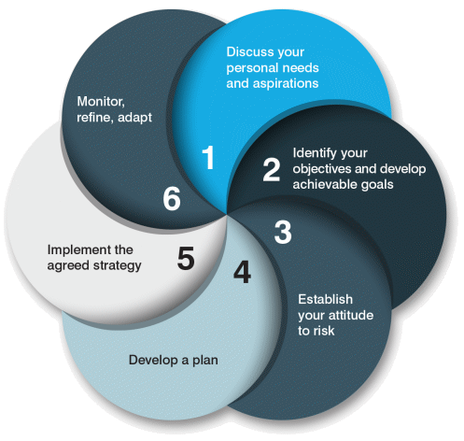

We follow a carefully designed financial planning process so that you know exactly what is happening at each stage of its six steps:

1. Discuss your personal needs and aspirations

Your circumstances are unique to you. So, the first step in your financial planning is to understand your situation and what you’d ideally like to achieve. We'll arrange an introductory meeting at our expense to fully explain how the service works. During our initial meeting we’ll discuss your finances, your income, dependents - and, more importantly, your aspirations for the future. we’ll answer any questions you may have and make sure we are the right fit for your needs. 2. Identify your objectives and develop achievable goals We will work with you to fully understand your objectives and develop these into well-defined goals. This will involve gathering financial information on any existing plans to enable us to provide a comprehensive picture of your circumstances. 3. Establish your attitude to risk If your personal goals include an element of investment planning (which most people’s do) we’ll establish the level of risk you feel comfortable with and understand your capacity for loss. Greater risks can mean greater potential rewards but also potentially greater losses. Your attitude to risk, and what stage you are at in your life, will have a great bearing on what is appropriate for you. Don't worry - we have straightforward, tried and tested ways to help you decide the level of risk right for you. We will then conduct the required research and planning to consider potential benefits and potential solutions to your objectives including the suitability of any existing plans. 4. Develop a plan Once we have agreed your goals and attitudes we can start to plan your portfolio. As truly independent advisers we can research the whole market for policies and investments which are absolutely right for your circumstances. We’ll set out specific and realistic recommendations presented in an easy-to-digest plan and take you through them stage by stage, aiming to achieve your stated objectives over an agreed period. Of course, nothing is final until you’re completely happy. 5. Implement the agreed strategy Once you fully understand our recommendations and are happy with them, we will put these into action for you. 6. Monitor, refine, adapt You can agree to an ongoing service from me to monitor and review your portfolio. This allows us to review your plans to make sure they are on track with your objectives and ensures you’re getting the best value and performance on the market. Our reviews will take account of any changes to your personal circumstances, financial market conditions and relevant legislation. If you prefer to manage this yourself it’s also fine, but we strongly encourage you to take an active interest in your wealth management. Here’s to a financially secure future! |

|