Hugh Matthews DipPFS, Certs CII (MP&ER) - Independent Financial Planner

Hugh’s career in financial services began in 2001 as a para-planner, which is a qualified, knowledgeable resource who supports advisers in portfolio planning for clients. Having progressed through the ranks of mortgage adviser and business owner in February 2019 Hugh joined the Crystal Wealth Management team.

He brings with him robust experience to offer to business and private clients in investments, business protection, wills, trusts, tax and estate planning. In particular, he specialises in pension planning. This has evolved from his early interest in psychology and philosophy (he graduated with a bachelor’s degree in cognitive science) and a genuine desire to help people to define their values, shape their attitude to risk and realise their retirement aspirations. His experience as a business owner adds to his understanding of the particular opportunities for commercial clients’ pension planning. A family man with two young children, Hugh enjoys cooking, all genres of music and has a passion for cars. Our Team

Our highly experienced team is at the heart of our business. We deliver consistently high standards and are committed to delivering an excellent customer experience for all our clients.

I am one of the ten truly independent advisers at Crystal Wealth who collectively have over two centuries of experience! We are supported by a team of para-planners, portfolio managers and front-of-house professionals who are qualified, efficient and customer-focused. We established ourselves as a team in 2003, our mission being to help businesses and individuals who can benefit from unbiased professional financial advice. We predominantly work in Bristol and the South West but we are happy to support clients further afield as required. Our Ethos

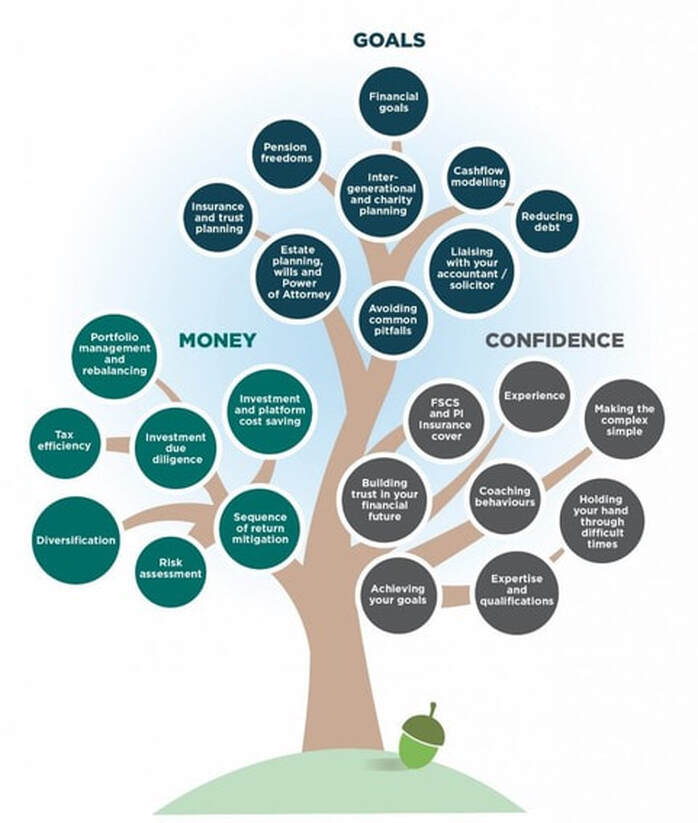

We believe that sound financial advice is central to building a more certain financial future for our clients. As qualified financial advisers, we have access to the most up to date technology to ensure we provide peace of mind that your financial future is more secure as a result of working with us. We specialise in investment and retirement planning, whether it is accumulating funds, making the transition from work to retirement or making the most of your capital in retirement. We are here to help. Our core values ensure that we always act with integrity and professionalism and are open and ethical in everything we do. We operate a transparent charging structure and put our clients’ best interests at the heart of the business. We believe that professional financial advice can add significant value to individuals and to businesses. It is because of this belief that we are able to offer a comprehensive ongoing review service designed to create real value for our clients. |

|

Value of Advice